The 1890 US federal census is gone, thanks to a fire in the 1930s. Only tiny fragments remain, and the chances of most people finding their ancestors in them are really remote. But, the absence of this important census leaves a gap of twenty years in the genealogical record, from 1880 to 1900. It can be frustrating to beginning genealogists to encounter this gap, especially if they are used to using the census for most of their American research.

The good news is that alternative records exist to help fill the gap left by the missing 1890 census. Tax records are one of them. This is what you need to know about them when you use them for your genealogy research.

The government has been collecting taxes in the United States since they were British colonies. In fact, the issue of taxation in the colonies without representation in the Parliament in Great Britain was one of the primary reasons for the American Revolution. Because taxation is such an important part of what governments do, it is easy to believe that there were very careful records kept of it at even the smallest levels of local government. This has been going on since ancient times. Some of the most ancient records we have from Egypt, Greece, Mesopotamia, and other early civilizations are tax records.

Believe it or not, tax records can be extremely helpful in bridging the gap of the 1890 US federal census. While the information on local tax records varies by location, you can find such useful tidbits of information on them like the name and dwelling place of the taxpayer, a description of that person’s real estate and other personal property, the name of the original purchaser of that property, whether the taxpayers are paying taxes as heirs on someone else’s estate, and more. You might even find information like the number of males over the age of twenty-one in a household, the number of children in the household who are of school age, and the number and type of farm animals at a household.

You can use annual tax rolls to help you discover, establish, and prove the ages of ancestors, where they lived, their relationships with other relatives in the household or prior owners of the home or land on which they live, and they date an ancestor death or moved to a different location.

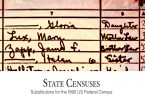

While tax records go back centuries in the United States, you will want to look for ones that fall between 1880 and 1900 to bridge the gap of the 1890 census. You can find them at state and local archives, historical societies, state and local government offices, and on some genealogy websites. FamilySearch.org and Ancestry.com both have collections that are searchable in indexes on the sites.

Wherever you choose to find tax records, they can be valuable tools in helping you get past the 1890 US federal census gap.